Running a successful business entails more than sheer determination and hard work. It also requires safeguarding your enterprise from the unexpected twists and turns that can disrupt your operations. One key aspect of protecting your business in Utah is having the right insurance coverage. Business insurance in the Beehive State can provide you with the peace of mind you need, ensuring that you are well-prepared for the risks that come with running a business.

As a business owner, knowing the ins and outs of business insurance in Utah is crucial. This comprehensive guide aims to equip you with the knowledge and understanding necessary to make informed decisions when it comes to selecting the right insurance policies for your specific needs. Whether you are a general contractor looking for insurance tailored to your industry or a hotel owner seeking protection for your property and guests, this guide covers it all.

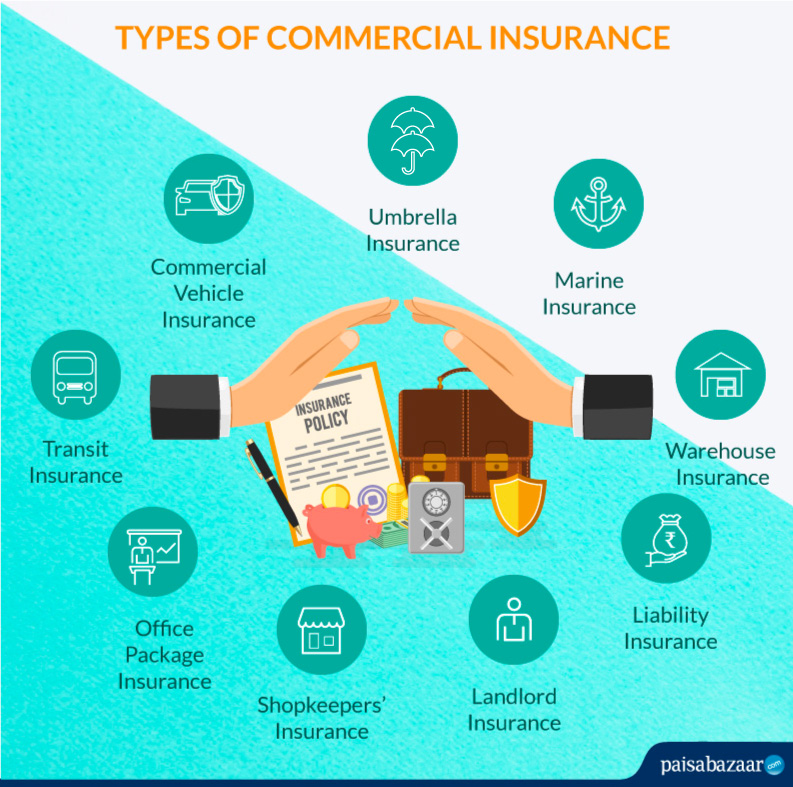

By exploring various facets of business insurance in Utah, such as liability coverage, property protection, and industry-specific policies, you will gain a deeper understanding of how insurance can play a vital role in fortifying your business against potential risks. So, let us delve into the world of business insurance in Utah, uncovering the key considerations, recommended policies, and expert advice that will help you insure your way to success.

Importance of Business Insurance in Utah

Having proper business insurance is crucial for entrepreneurs and businesses operating in the state of Utah. It provides financial protection and peace of mind in the event of unforeseen circumstances. In this guide to business insurance in Utah, we will explore why insurance is paramount for businesses in the Beehive State.

Safeguarding Against Risks

Every business faces risks, whether it’s a small startup or a well-established corporation. From natural disasters like wildfires or earthquakes to accidents and lawsuits, these risks can pose significant threats to a company’s financial stability. Business insurance helps mitigate these risks by providing coverage for property damage, liability claims, and even employee injuries.

Compliance with Utah Laws

To operate legally in Utah, businesses must comply with state laws and regulations. This includes having the appropriate insurance coverage based on the type of business and industry. For instance, general contractors must have insurance specifically tailored to their profession, while hotels and accommodations require coverage designed for the hospitality sector. By adhering to these legal requirements, businesses can avoid penalties and ensure their operations are in line with Utah’s business regulations.

Protecting Business Assets and Reputation

Business insurance not only safeguards physical assets but also helps preserve a company’s reputation. In the event of property damage or loss, insurance coverage can provide financial support to repair or replace assets, minimizing disruption to business operations. Additionally, liability insurance can offer protection against claims of negligence or injury, preserving a company’s reputation and credibility in the eyes of customers and the public.

In conclusion, having adequate business insurance is essential for Utah businesses to protect themselves from potential risks and comply with state regulations. By investing in the right insurance coverage, entrepreneurs can ensure the long-term success and stability of their ventures in the dynamic business landscape of Utah.

Insurance for General Contractors in Utah

General contractors in Utah play a crucial role in the construction industry. They oversee and manage various aspects of a construction project, ensuring that everything runs smoothly from start to finish. However, with great responsibility comes potential risks. That’s why it’s essential for general contractors in Utah to have the right insurance coverage.

First and foremost, general contractors should consider obtaining general liability insurance. This type of insurance protects them from financial loss in case they are held legally responsible for any bodily injury or property damage that occurs during the course of their work. Accidents can happen, and having general liability insurance can provide invaluable protection and peace of mind.

In addition to general liability insurance, general contractors in Utah should also consider getting professional liability insurance. This type of insurance, also known as errors and omissions insurance, is designed to protect against claims of negligence, errors, or omissions in professional services provided. As general contractors often provide advice and guidance throughout the construction process, having professional liability insurance is crucial in protecting against potential lawsuits.

Lastly, general contractors should consider obtaining property insurance. This type of insurance would cover any buildings, equipment, or tools that are owned or leased by the contractor. Given the nature of their work, general contractors often have valuable assets that need protection from events such as fire, theft, or vandalism.

In conclusion, general contractors in Utah should be proactive in securing the right insurance coverage to protect themselves and their businesses. Having general liability, professional liability, and property insurance in place can provide the necessary safeguards against unforeseen events and potential losses. By mitigating risks through comprehensive insurance coverage, general contractors can focus on what they do best – managing successful construction projects.

Insurance for Hotels in Utah

When it comes to running a hotel in Utah, having the right insurance coverage is essential for protecting your business and guests. The unique risks and challenges faced by hotel owners require specialized insurance policies that can safeguard against a range of potential issues. In this section, we will explore the key considerations and insurance options available for hotels in Utah.

-

Property Insurance: As a hotel owner, your property is a valuable asset that needs to be protected. Property insurance provides coverage for damages to the building, furnishings, equipment, and other physical assets related to your hotel. In Utah, where unpredictable weather events such as snowstorms and earthquakes can occur, having the right property insurance coverage is crucial.

-

Liability Insurance: Hotels can be susceptible to various liability risks. From slip-and-fall accidents to guest injuries or property damages, there are numerous situations where you could be held legally responsible. Liability insurance for hotels in Utah helps protect against these risks by providing coverage for legal expenses, medical costs, and settlements or judgments that may arise from such incidents.

-

Business Interruption Insurance: In the event of a disaster or unforeseen circumstance such as a fire or natural disaster, your hotel may need to temporarily close its doors. This can result in significant financial loss due to lost revenue and ongoing expenses. Business interruption insurance can help by providing coverage for the loss of income and necessary expenses, helping you get back on your feet as quickly as possible.

Understanding the specific insurance needs of hotels in Utah is crucial to ensure proper protection for your business and guests. By choosing the right insurance policies, you can operate with peace of mind knowing that you are prepared for any unforeseen events that may arise.